Simplify your PF online payment process with our easy guide. Learn eligibility, benefits, and step-by-step instructions today!

Understanding PF Online Payment: A Simple Guide

Managing your Employees’ Provident Fund (EPF) is crucial, and staying on top of payments ensures financial security. With PF online payment, both employers and employees can make transactions hassle-free. This guide will walk you through everything about PF payments, eligibility, benefits, and more.

EPF Account Explained

An EPF (Employees’ Provident Fund) account is a savings scheme that provides financial security to employees after retirement. Every month, a portion of the employee’s salary goes into this fund, and the employer contributes an equal amount. The Employees’ Provident Fund Organisation (EPFO) under the Ministry of Labour and Employment in India manages the EPF scheme.

The EPF account helps employees systematically save money, ensuring they have a financial cushion when they retire. It also earns interest on the accumulated amount, making it a reliable long-term savings option.

Understanding PF Payment

A PF payment is the monthly contribution made to an employee’s EPF account. Employers and employees contribute a fixed percentage of the employee’s salary to the fund. Employers must deduct the employee’s share and deposit the total contribution with the EPFO by the due date.

The PF contributions are calculated based on the employee’s basic salary and dearness allowance (DA). These contributions build a retirement fund and can be withdrawn under specific conditions.

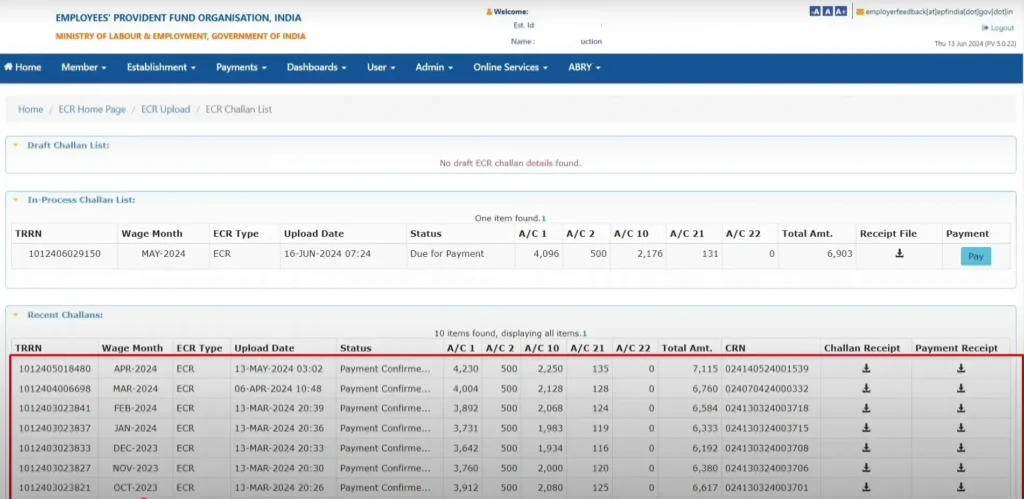

Guide to Making PF Online Payment

Making PF payments online is now easier than ever. Employers can deposit their contributions through the EPFO portal without visiting a bank. Follow these steps:

- Log in to the EPFO Portal: Visit the official EPFO website and use employer credentials to log in.

- Generate the ECR (Electronic Challan cum Return): Prepare the monthly contribution details and generate the ECR file.

- Upload the ECR File: Upload the file to the portal for validation.

- Verify Payment Details: Confirm the total amount payable.

- Make Payment: Use Net Banking, Debit Card, or other online methods to pay.

- Download Receipt: Save the challan for records after successful payment.

Completing these steps on time helps employers avoid penalties.

Consequences of Late PF Payment

Timely PF payments are important to avoid penalties and comply with EPFO regulations. Delays in contributions can result in the following penalties:

- Interest on Late Payment: EPFO charges 12% interest per annum for each day of delay.

- Penalty Charges: Additional damages range from 5% to 25% of the total dues, based on the delay duration.

Employers should ensure PF payments are made before the 15th of each month to avoid penalties.

Eligibility and Required Documents for PF Payment

Before making PF online payments, it’s important to check eligibility and have the required documents ready. Here’s what you need:

Eligibility:

- Organizations with 20 or more employees must register under the EPF Act.

- workers who receive a base pay of up to Rs. 15,000 per month are mandatorily covered.

- Employees with higher salaries can opt for PF voluntarily.

Documents Required:

- Employer’s PAN card

- Establishment registration certificate

- Employee details (Aadhaar, bank details, etc.)

- Employer’s digital signature for authentication

Having all documents ready ensures a smooth process.

Advantages of PF Online Payment

Employers and employees both benefit from the many advantages that PF online payment provides. Key advantages include:

- Convenience: Payments can be made anytime, anywhere without visiting banks.

- Faster Processing: Online payments are processed instantly, avoiding delays.

- Reduced Errors: Automation minimizes human errors in calculations.

- Paperless Transactions: Digital records provide easy access and future reference.

- Security: Online transactions ensure safe fund transfers.

Employers can comply with EPFO guidelines effortlessly by using online payment options.

Checking EPF Payment Status

Employees can easily check their PF payment status online through multiple methods:

- Via the EPFO Portal: Log in to the UAN portal and check the passbook.

- Through SMS Service: Send an SMS with “EPFOHO UAN ENG” to 7738299899.

- Missed Call Service: Dial 9966044425 from the registered mobile number.

- UMANG App: Download the UMANG app and access EPF account details.

These options help employees stay updated on their PF contributions and balances.

Frequently Asked Questions About PF Online Payment

1. Can I pay my PF contribution myself?

No, only employers can make PF contributions on behalf of employees.

2. What happens if my employer fails to make PF payments?

Employers may face penalties and legal action from the EPFO.

3. How long does it take for a PF payment to reflect in my account?

It usually takes 2-3 working days for the payment to reflect in the EPF passbook.

4. Is it possible to revise PF contributions after payment?

No, once the payment is made, revisions can be done only in the next cycle.

5. Can I withdraw PF online?

Yes, employees can submit a withdrawal claim through the UAN portal.

By staying informed and making timely PF online payments, employers can ensure compliance, and employees can enjoy the benefits of financial security post-retirement.