Learn how to apply for advance PF withdrawal online, eligibility criteria, required documents, step-by-step process, withdrawal limits, and tax implications.

Understanding Advance PF Withdrawal

The Employees’ Provident Fund (EPF) serves as a long-term retirement savings scheme, but in certain situations, employees may need to withdraw a portion of their funds before retirement. This is known as Advance PF Withdrawal. EPFO allows withdrawals under specific conditions like medical emergencies, home loan repayment, marriage, and unemployment. This guide will walk you through the eligibility criteria, required documents, and step-by-step process for applying for an advance PF withdrawal online.

EPFO Advance PF Withdrawal – Quick Guide

To withdraw your EPF balance in advance, follow these steps:

- Visit the EPFO Unified Portal (Unified Portal) or UMANG App.

- Login with UAN & Password, go to Online Services > Claim Form-31.

- Enter withdrawal reason, verify Aadhaar OTP & submit.

- Track your claim via EPFO Portal or UMANG App.

Offline PF Withdrawal Process

If you are unable to apply for PF withdrawal online, you can opt for the offline process by following these steps:

- Download Form-31 (Advance PF Withdrawal Form) from the EPFO website or collect it from the nearest EPFO office.

- Fill out the form with accurate details including your UAN, PF account number, bank details, and reason for withdrawal.

- Attach required documents such as Aadhaar, PAN, canceled cheque, and any additional proofs (medical, education, or home loan documents as per withdrawal reason).

- Get employer attestation (if required) and submit the form at your regional EPFO office.

- EPFO will process the claim and credit the amount directly into your registered bank account within 15-30 days.

EPFO’s Latest Rule Changes (2025 Updates)

EPFO has introduced some important updates for advance PF withdrawal:

✅ Faster Claim Settlement – EPFO aims to settle online withdrawal claims within 3-5 working days, reducing the previous processing time. ✅ Facial Recognition for Jeevan Pramaan – Pensioners can now verify their identity using facial authentication instead of biometric verification. ✅ Auto KYC Update – EPFO now auto-updates bank and Aadhaar details to ensure seamless transactions. ✅ Increased COVID-19 Emergency Withdrawals – Members can now withdraw up to 75% of their PF balance during emergencies. ✅ Nidhi Aapke Nikat 2.0 Grievance Redressal Camps – EPFO conducts monthly grievance camps in various districts to resolve member issues quickly.

What is Advance PF Withdrawal?

Advance PF Withdrawal allows EPFO members to withdraw part of their Provident Fund (PF) balance before retirement for specific reasons like medical emergencies, home loans, marriage, or education.

Eligibility for Advance PF Withdrawal

- Active UAN (Universal Account Number).

- Aadhaar & Bank account linked with EPFO.

- Specific service period may apply (e.g., minimum 3 years for house purchase).

- Withdrawal purpose should match EPFO’s approved list.

Permitted Reasons for Advance PF Withdrawal

| Purpose | Maximum Withdrawal Limit | Eligibility Condition |

|---|---|---|

| Medical Treatment | 6 months’ PF wages or employee share | For self/family illness |

| Home Loan Repayment | Up to 90% of EPF balance | Minimum 3 years of service |

| Marriage/Education | 50% of PF balance | Minimum 7 years of service |

| COVID-19 Withdrawal | Up to 75% of EPF balance | No service limit |

| Unemployment | 75% of balance after 1 month | Remaining 25% after 2 months |

Documents Required for PF Withdrawal

- Aadhaar Card & PAN Card.

- UAN (Universal Account Number).

- Bank Account Details (Cancelled Cheque).

- Supporting documents (Medical certificate, Loan documents, etc.).

How to Apply for Advance PF Withdrawal Online?

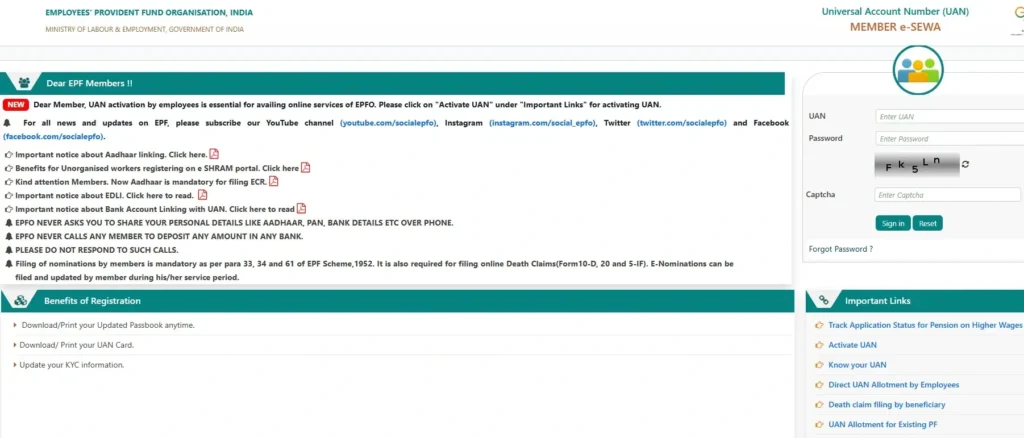

✅ Using EPFO Unified Portal

- Login to EPFO Member Portal .

- Go to Online Services > Claim (Form-31,19,10C & 10D).

- Verify your bank details & Aadhaar OTP.

- Select withdrawal reason & enter amount.

- Upload supporting documents (if required).

- Submit the claim & save tracking ID.

✅ Using UMANG Mobile App

- Open UMANG App and go to EPFO Services.

- Choose Request for Advance PF Withdrawal.

- Enter UAN & verify Aadhaar OTP.

- Select withdrawal reason and enter details.

- Submit claim & track status.

How to Track PF Withdrawal Status?

- EPFO Unified Portal – Check claim under Online Services > Track Claim Status.

- UMANG App – Go to EPFO Services > Claim Status.

- SMS Service – Send EPFOHO UAN ENG to 7738299899.

- EPFO Helpline – Call 1800-118-005 for claim updates.

Common Issues & Solutions for PF Withdrawal

- Claim Rejected? – Check Aadhaar, UAN, & Bank details.

- Pending at Field Office? – Contact regional EPF office.

- Bank Account Not Verified? – Update KYC details.

- No Response from Employer? – File complaint via EPFiGMS Portal.

Tax Implications on PF Withdrawal

- TDS @ 10% if withdrawn before 5 years of service.

- No TDS if withdrawal is below ₹50,000.

- Form 15G/15H required for tax exemption (if applicable).

Filing a Complaint for PF Withdrawal Issues

- EPFiGMS Portal (epfigms.gov.in) – File grievances online.

- Visit Regional EPFO Office for direct resolution.

- Social Media Support – Contact EPFO via Twitter or Facebook.

“Learn how to withdraw your PF online through the EPFO portal with our detailed guide on PF Withdrawal Online. It covers eligibility, required documents, and a step-by-step process to claim your provident fund easily.”

This summary can be linked within the Advance PF Withdrawal article as:

For a detailed guide on withdrawing your entire PF balance online, check out our PF Withdrawal Online article.

FAQs – Advance PF Withdrawal

1. How long does it take to process an advance PF withdrawal?

- Generally, 5-15 working days depending on the verification process.

2. Can I withdraw PF for personal reasons?

- No, withdrawal is allowed only for EPFO-approved reasons (Medical, Home, Marriage, Education, etc.).

3. What happens if my withdrawal request is rejected?

- Check if Aadhaar, UAN, and bank details are correct and resubmit the request.

4. Can I withdraw 100% of my PF balance in advance?

- No, the withdrawal limit depends on the purpose (Refer to the Permitted Reasons Table above).

5. How do I contact EPFO for withdrawal-related queries?

- EPFO Toll-Free Number: 1800-118-005.

- EPFiGMS Portal: File Complaint.

- Visit Nearest EPFO Office.

Final Thoughts

Applying for Advance PF Withdrawal Online is now easy with the EPFO Unified Portal & UMANG App. By following the step-by-step process in this guide, you can successfully withdraw your PF amount without delays.

For more EPFO-related updates, visit epfindia.online.