PF Withdrawal Online – Complete Step-by-Step Guide (2025)

Managing your Provident Fund (PF) withdrawal online has become much easier with the digitization of EPFO services. Instead of standing in long queues at the PF office, you can now settle your claims directly through the EPFO Member e-Sewa portal or the UMANG app.

This guide covers everything—eligibility rules, types of forms, step-by-step process, tax implications, error fixes, and FAQs—to help you complete your PF withdrawal online without confusion.

What Is PF Withdrawal Online?

PF withdrawal online means submitting a digital claim for:

- Form 19 – Final PF settlement after leaving service

- Form 10C – Pension withdrawal benefit / Scheme Certificate

- Form 31 – Partial withdrawal (advance) for special needs

These forms can be filed through the EPFO Member e-Sewa portal or UMANG app with Aadhaar-based authentication.

Eligibility for PF Withdrawal Online

Not every PF member can withdraw anytime. The eligibility depends on:

- Final settlement (Form 19): Allowed only after leaving employment, with 2 months of unemployment.

- EPS withdrawal (Form 10C): For service less than 10 years or to get a Scheme Certificate.

- Partial advance (Form 31): For medical treatment, house construction/repair, marriage, education, natural calamity, unemployment advance, or pre-retirement needs.

Prerequisites Before Applying

Before filing your PF withdrawal online, ensure the following:

- Activated UAN (Universal Account Number)

- Aadhaar seeding and e-KYC approval

- Bank account with IFSC mapped to UAN

- PAN card (to reduce TDS liability)

- Registered mobile number for OTP authentication

💡 Tip: The EPFO has integrated Face Authentication in UMANG app to help members without biometric devices complete KYC and claim filing.

Types of PF Withdrawal Claims (Forms Explained)

Here’s a quick overview of forms used in PF withdrawal online:

| Form | Purpose | When to Use |

|---|---|---|

| Form 19 | Final PF settlement | On leaving job / retirement |

| Form 10C | Pension withdrawal benefit or Scheme Certificate | Service <10 years or to retain pension credit |

| Form 31 | Advance (partial withdrawal) | Medical, marriage, education, housing, unemployment, calamity |

Step-by-Step Guide – EPFO Member e-Sewa Portal

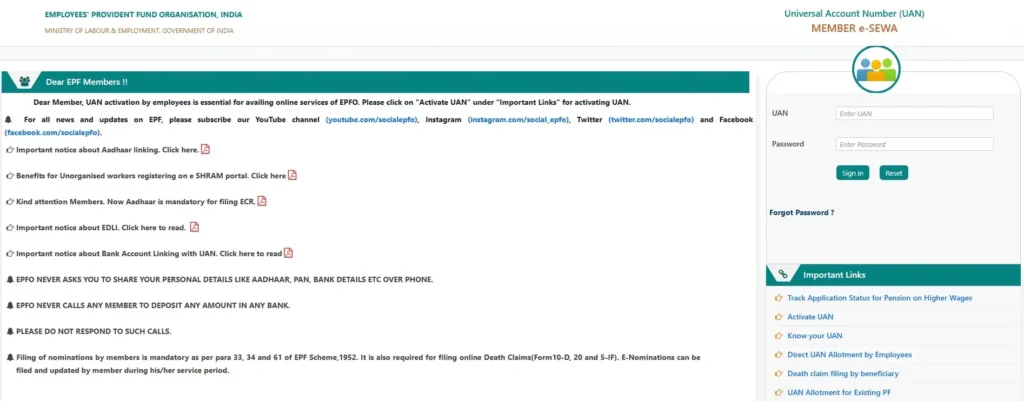

- Go to EPFO Member e-Sewa portal.

- Log in with UAN + password.

- Go to Online Services → Claim (Form 31, 19, 10C, 10D).

- Verify bank details and Aadhaar.

- Select the claim type (19, 10C, or 31).

- For Form 31, enter reason, amount, and upload documents if required.

- Authenticate with Aadhaar OTP e-sign.

- Submit and note the claim reference number.

Track status under Online Services → Track Claim Status. Final settlement credits appear in your EPF Passbook.

Step-by-Step Guide – UMANG App

- Download and open UMANG app.

- Navigate: All Services → EPFO → Employee Centric Services.

- Tap Raise Claim.

- Select claim type (Form 19/10C/31).

- Authenticate via Aadhaar OTP or Face Authentication.

- Submit claim and track under Track Claim Status.

PF Withdrawal Processing Time

- Typically 5–20 working days if KYC is correct.

- Delays occur due to employer exit not updated, bank/Aadhaar mismatch, or incomplete KYC.

- With EPF 3.0 rollout, EPFO has announced instant withdrawals via UPI/ATMs—expected to make small claims faster in the coming months.

Tax on PF Withdrawal Online

Tax rules under Section 192A:

- Withdrawal before 5 years of service → taxable.

- TDS @ 10% if PAN is provided.

- TDS @ 30% if PAN not provided.

- No TDS if withdrawal ≤ ₹50,000 (as per latest limits).

- After 5 years, withdrawals are tax-free.

💡 Pro tip: Instead of withdrawing, consider transferring PF balance to the new employer to avoid tax deduction and retain pension benefits.

Common Errors & Fixes in PF Withdrawal Online

- Name mismatch (Aadhaar vs UAN): Update KYC in Member profile.

- Incorrect bank IFSC: Update through employer → approve KYC.

- Employer exit not updated: Request employer to update exit date digitally.

- Multiple UANs: Merge UANs through the portal.

- OTP failure: Use UMANG’s Face Authentication alternative.

People Also Ask – FAQs

Can I withdraw PF online while still employed?

No, only advances via Form 31 are allowed. Final settlement requires job exit.

Do I need employer approval for PF online withdrawal?

Not if Aadhaar and KYC are fully seeded. Employer exit must be updated.

How long does online PF withdrawal take?

Usually 5–20 working days, but delays may occur due to KYC issues.

Is PAN mandatory for PF withdrawal online?

Not mandatory, but without PAN, higher TDS (30%) applies.

How can I check PF withdrawal status?

Track on EPFO portal or UMANG app; credit reflects in your passbook.

What is the difference between Form 19, 10C, and 31?

Form 19 = PF settlement, Form 10C = pension benefit, Form 31 = advance.

Can I withdraw PF online using UMANG app?

Yes, UMANG supports claim filing, tracking, and Aadhaar/Face Auth login.

Will EPFO allow instant withdrawals via ATM/UPI?

Yes, announced under EPF 3.0, rolling out gradually.

Conclusion

With proper KYC, Aadhaar, PAN, and bank details, you can easily complete PF withdrawal online via EPFO’s Member portal or UMANG app. Always choose the correct claim form, understand tax implications, and track your claim digitally.

By staying updated with EPFO’s new instant withdrawal features, you can enjoy faster settlements and hassle-free access to your retirement savings.

Dear sir

Please my pf withdrawal my update account number.

Very very udgently so. My sister marrieg.

Please my pef withdrawal in my account

pf amount withdrawal

dear sir

my pf amount withdrawal please my account balenc statement

please follow the epf withdrawal rules

Sir my unr and pf number sand kro

epf on line withdrol. pla.arjent work for money my una no. Dnyneshwar Ramanath Pawar.

we cannot understand what you are asking ???

PLEAS SIR WITHDROL MY PF

CAN U HELP ME ?

I KNOW MY UAN NUMBER PLEASE HELP ME

THENK U .

sure sir.. visit uan login portal and login in it. check your uan balance and withdraw apply…

Hi, I am facing password not reset issue & i have two different UAN number so one of them not able to reset password i tried to multiple time now portal showed error ” you have maximum limit reached to sent OTP ” & when all the time i received OTP & proceed to reset password but not reset & change so humble to request to you please provide resolution if possible & also suggest what to do in case ” Two different UAN Account issue”…. Thank You.